Gold has long held its place as a safe-haven asset during times of economic uncertainty. Traders worldwide rely on the XAU/USD pair—gold priced in US dollars—as a key instrument in their portfolios. With its high liquidity and significant daily price movements, XAU/USD presents frequent trading opportunities for those who understand its rhythm. On Exness, this asset is available under favorable trading conditions that suit both technical and fundamental approaches.

Why Trade Gold (XAU/USD) on Exness?

Choosing the right broker is crucial when trading gold, especially one that offers strong execution infrastructure and competitive pricing. Exness provides gold trading via Contracts for Difference (CFDs), meaning traders can speculate on price movements without needing to hold the physical asset.

Several factors make gold trading with Exness practical for many traders:

- Low spread environment: Spread from as low as 0.0 pips for Zero accounts.

- Instant withdrawals: Automation ensures swift access to funds, including during weekends.

- High execution speed: Orders typically filled in milliseconds across trading platforms.

- Diverse payment options: A wide range of local and global payment systems, especially in regions like Nigeria.

Exness integrates technology with transparent pricing to allow efficient gold trading strategies with minimal friction.

Trading Conditions for Gold (XAU/USD) on Exness

Gold trading conditions vary depending on the type of trading account chosen and platform preferences. Here’s a breakdown of key conditions to expect when trading gold CFDs with Exness.

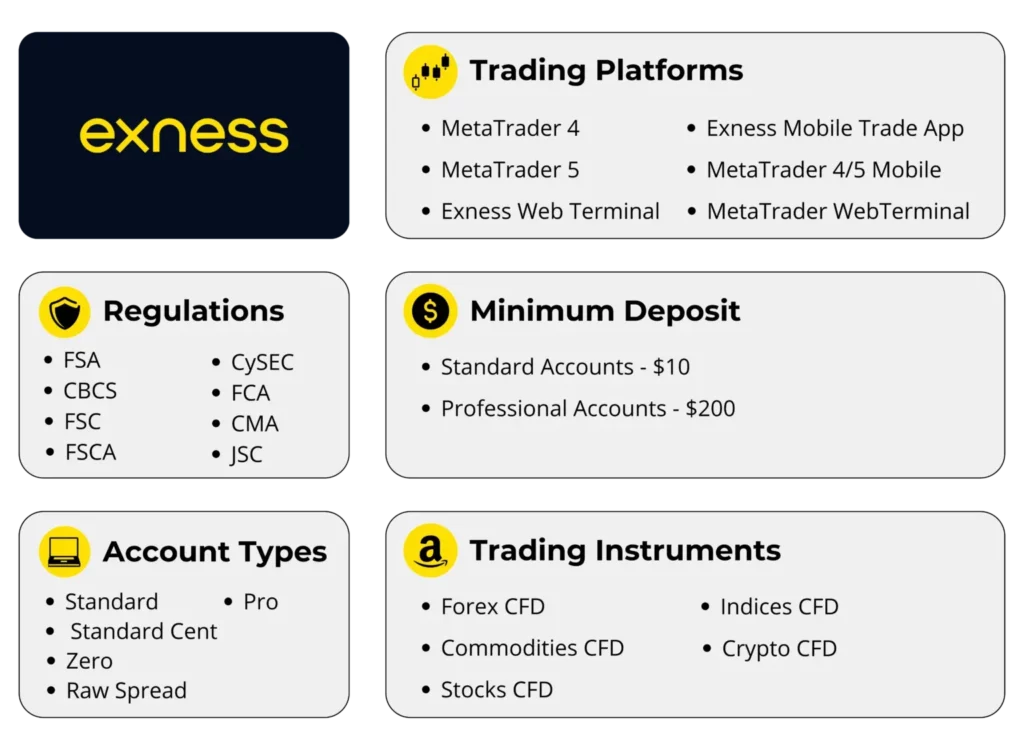

Account Types and Gold Trading

Exness offers several account types tailored to different trading styles. Below is a comparison focused on gold (XAU/USD) trading:

| Account Type | Minimum Deposit | Spread from (pips) | Commission | Execution Type | Platform |

|---|---|---|---|---|---|

| Standard | No minimum | From 0.3 | None | Market Execution | MT4, MT5 |

| Pro | $200 | From 0.1 | None | Market Execution | MT4, MT5 |

| Raw Spread | $200 | From 0.0 | $3.50/lot | Market Execution | MT4, MT5 |

| Zero | $200 | 0.0 (most of the day) | $0.2–$3.5/lot | Market Execution | MT4, MT5 |

Traders seeking tighter spreads on gold might lean toward Zero or Raw Spread accounts, particularly during peak trading hours.

Exness Leverage for Gold Trading

Exness offers dynamic leverage on gold, which adjusts based on the size of the position. For many traders, leverage up to 1:2000 or even unlimited may be available, depending on account equity and trading volume. Leverage conditions also vary depending on whether the account falls under regulated jurisdictions.

Leverage model for gold:

| Account Equity | Maximum Leverage Available |

|---|---|

| ≤ $999 | Up to Unlimited |

| $1,000 – $4,999 | Up to 1:2000 |

| $5,000 – $29,999 | Up to 1:1000 |

| ≥ $30,000 | Up to 1:500 |

It’s essential to monitor margin requirements, as higher leverage amplifies both gains and losses.

Trading Hours and Market Liquidity for XAU/USD

Gold is traded almost 24/5, with its highest liquidity during the overlap of the London and New York sessions.

| Trading Session | Time (UTC) | Liquidity Level |

|---|---|---|

| Asian Session | 00:00 – 06:00 | Low |

| London Session | 08:00 – 16:00 | High |

| New York Session | 13:00 – 21:00 | Very High |

Spreads and slippage tend to be tighter during overlapping hours. Nigerian traders might find optimal conditions from 2 PM to 6 PM (local time), when both major markets are active.

Exness Gold Spread and Fees

Understanding trading costs is essential when trading gold. Spreads and commissions can significantly impact net profitability, especially for short-term strategies. On Exness, the cost structure for trading XAU/USD is transparent and competitive across different account types.

Gold spreads are influenced by multiple factors such as market liquidity, account type, and trading session. While the Standard account offers variable spreads starting from 0.3 pips, Zero and Raw Spread accounts often provide tighter pricing, sometimes down to 0.0 pips, particularly during high-liquidity periods:

| Account Type | Typical Spread (XAU/USD) | Commission | Total Cost (Est.) |

| Standard | 0.3 – 0.8 pips | None | Low |

| Pro | 0.1 – 0.4 pips | None | Very Low |

| Raw Spread | 0.0 – 0.3 pips | $3.50 per lot | Moderate |

| Zero | 0.0 (90% of the day) | $0.2–$3.5/lot | Ultra Low |

How Exness Gold Spread Compares to Other Brokers

Many brokers offer gold trading, but the cost-to-trade can vary widely. Here’s a comparative overview based on typical spread benchmarks for XAU/USD:

| Broker Name | Minimum Spread on Gold | Commission | Execution Model |

| Exness | From 0.0 pips | $0–$3.5 | Market Execution |

| Broker A | From 0.5 pips | $6/lot | Market Execution |

| Broker B | From 0.3 pips | $4/lot | Instant Execution |

| Broker C | From 0.2 pips | $5/lot | ECN/STP Hybrid |

Exness offers highly competitive spreads for gold, especially when factoring in execution speed and zero hidden fees. The platform’s structure suits both high-frequency and positional traders.

How to Trade Gold (XAU/USD) on Exness

Getting started with gold trading on Exness is a straightforward process. The platform supports MetaTrader 4 and MetaTrader 5, which are compatible with desktop, mobile, and web interfaces.

Setting Up Your Exness Account for Gold Trading

To begin trading XAU/USD on Exness, follow these steps:

- Register a Personal Area: Visit the official Exness website and create a personal account by providing a valid email and password. Choose your country of residence carefully, as it determines available services.

- Complete Verification: Submit proof of identity and proof of residence documents to unlock full access and deposit options.

- Choose an Account Type: Select from Standard, Pro, Raw Spread, or Zero based on your strategy and cost sensitivity. Traders focused on gold trading might consider Raw Spread or Zero accounts for tighter pricing.

- Make a Deposit: Use one of the local or international payment methods. In Nigeria, options like internet banking and e-wallets are commonly available.

- Download and Login to MT4/MT5: Install MetaTrader on your desktop or smartphone. Log in using the credentials provided in your personal area.

- Find XAU/USD in Market Watch: Add XAU/USD to your watchlist and open a new chart to begin technical analysis or place orders.

- Manage Risk: Use Stop Loss, Take Profit, and appropriate lot sizing based on your risk management plan.

Popular Trading Strategies for Gold (XAU/USD)

Gold reacts to a variety of market influences—economic data, geopolitical shifts, and central bank policy, making it suitable for various trading strategies. Whether targeting short intraday moves or longer trends, gold offers versatility.

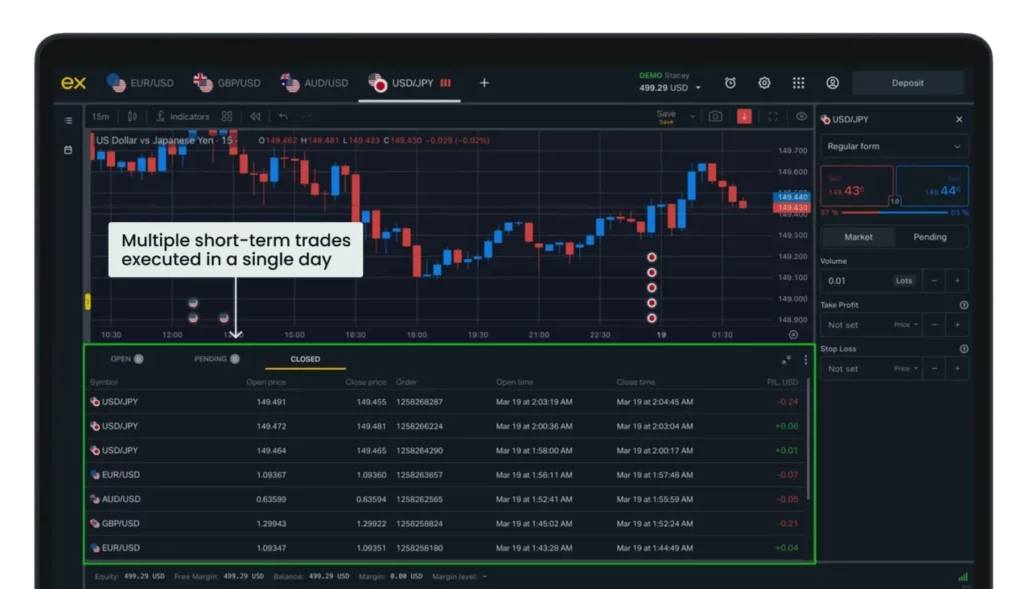

Day Trading Strategies for Gold

Day traders focus on price movement within the same trading session. Some popular techniques include:

- Breakout Trading: Identify periods of consolidation and place trades when price breaks above resistance or below support. Gold tends to move strongly once it exits tight ranges.

- Scalping Volatility: This method involves placing high-frequency trades using 1-minute or 5-minute charts. Spreads and execution speed become crucial here, making Exness Zero and Raw Spread accounts ideal.

- News-Based Trading: Gold often reacts sharply to macroeconomic events such as inflation data, interest rate decisions, and job reports. Use an economic calendar and trade the volatility.

- Support and Resistance Trading: Look for strong historical levels where price has bounced or reversed. These zones often serve as entry or exit points for both buyers and sellers.

Best Times to Trade Gold in the Nigerian Market

Gold trading is most active when both London and New York sessions overlap. For Nigerian traders (WAT, UTC+1), this overlap occurs between 2 PM and 6 PM.

| Time (WAT) | Trading Session | Gold Market Activity |

| 7 AM – 12 PM | London Open | Moderate |

| 2 PM – 6 PM | London/New York Overlap | High |

| 7 PM – 9 PM | Late US Session | Moderate–Low |

During the overlap, market depth improves, spreads tighten, and slippage tends to reduce, which is ideal for both day traders and scalpers operating within Nigeria’s timezone.

Frequently Asked Questions

What is the minimum deposit to trade gold on Exness?

There is no fixed minimum deposit for Standard and Pro accounts. However, Raw Spread and Zero accounts typically require a starting deposit of around $200, depending on the selected payment method and account currency.