What is the Exness Calculator and How It Works

Exness Calculator is a tool designed to help traders calculate key trading metrics before placing trades. It allows you to estimate important values like margin requirements, potential profit or loss, and swap rates based on the parameters you input, such as trade size, leverage, and the instrument you want to trade. This gives traders a clearer understanding of the risks and potential returns involved in each trade, helping them make more informed decisions.

To use the Exness Calculator, simply enter the necessary information, such as the trading instrument, lot size, leverage, and account type. The calculator then generates key figures like margin, pip value, swap fees, and projected profit or loss, allowing you to plan your trades more effectively. By understanding these numbers ahead of time, you can better manage your risk and optimize your trading strategy.

Main Functions and Features of the Exness Calculator

Exness Calculator will help the trader pre-calculate the key parameters: margin, swap fees, pip value, and potential profit or loss. The calculator simplifies planning trades and controlling risks and enables the decision maker to decide whether to enter a trade.

Key Features

Exness Calculator offers several useful features to optimize your trading:

- Margin Calculation: Estimate the margin required for each trade.

- Swap Fees: Calculate overnight fees for long or short positions.

- Profit and Loss Projection: Determine potential outcomes based on input values.

- Pip Value: Know the pip value for better risk control.

These features make it easier for traders to manage their strategies and assess risks effectively before executing trades.

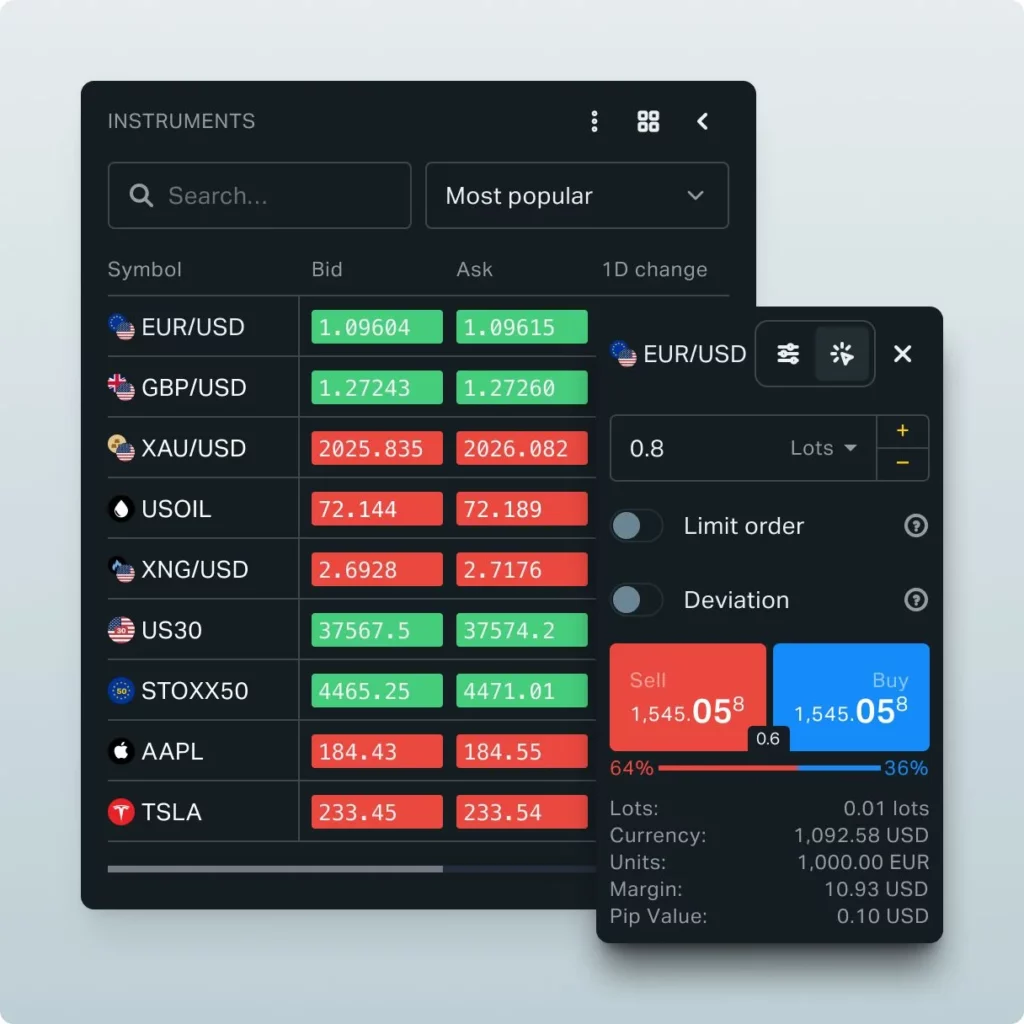

Supported Instruments

Exness Calculator supports a wide range of instruments for diverse trading:

- Forex: Major, minor, and exotic currency pairs.

- Commodities: Gold, silver, and oil.

- Indices: Global stock indices like S&P 500, NASDAQ.

- Cryptocurrencies: Bitcoin, Ethereum, and more.

With these supported instruments, traders can use the calculator to plan trades across different markets.

How to Use Exness Calculator

Exness Calculator is easy to use and helps traders plan trades effectively by calculating important metrics. Simply follow these steps to ensure accurate calculations for your trades.

Step-by-Step Instructions

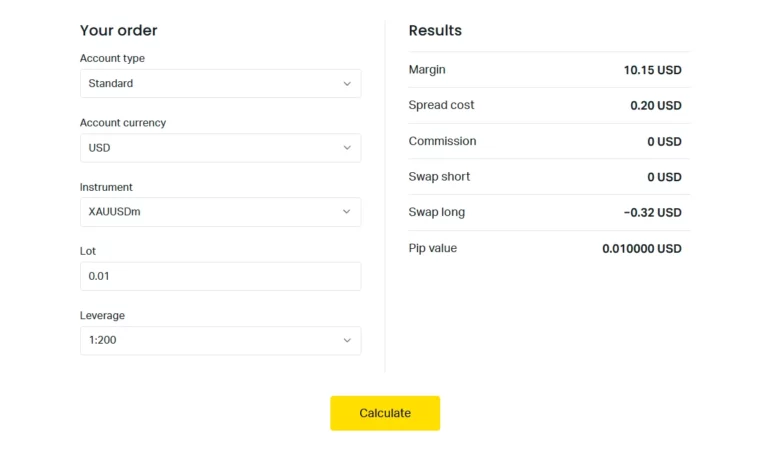

Using the Exness Calculator is simple and helps traders quickly estimate essential trading figures like margin, swap fees, and potential profit or loss. Follow these steps to use the calculator efficiently:

- Open the Exness Calculator on the official website.

- Select the trading instrument you wish to analyze.

- Enter your trade size (lots) and set the leverage for the trader.

- Input the current price of the instrument for accurate calculations.

- Click “Calculate” to get detailed results like margin, profit/loss, and swap fees.

This quick process allows traders to estimate their potential returns and risk before executing a trade, making trade planning easier.

Input Parameters

To get accurate calculations, you need to enter the correct input parameters. These include:

- Instrument: Choose the asset you’re trading, such as forex, commodities, or indices.

- Lot Size: Input the number of lots for your trade.

- Leverage: Enter the leverage ratio based on your account settings.

- Price Levels: Provide the entry and exit prices for better profit/loss estimates.

These input parameters ensure that the calculator provides you with accurate data, helping you plan your trades effectively.

Explanation of Input Parameters and Results

The following are the input parameters that the Exness Calculator requires: the trading instrument-which can mean the asset you are trading, forex pairs, commodities, and indices. Lot size-the size of a lot determines the trade volume and also impacts the calculation of margin and profit. Leverage-the parameter stipulates the level of leverage to be used within your trade. It impacts the calculation of margin requirements for your trade. Finally, entry and exit prices are given to estimate possible profit and loss in addition to swap fees.

This calculator will provide the necessary trading metrics once you have set the parameters. The margin result shows how much capital will be needed to enter the trade, while the pip value is a monetary value of each pip movement and can help calculate your risk. Swap fees signify the overnight costs for holding positions, while the profit/loss result estimate computes the estimated potential earnings or losses based on the price levels provided. These results will help traders plan their trades with better transparency and support them in effectively managing their risk.

Example of Using the Exness Calculator

Exness calculator is designed for traders to plan their trade in advance by predicting the size of the margin, profit/loss, and swap fees. Let’s now go through an example using this calculator for a Forex trade and margin calculation.

Forex Trade Example

Suppose you are going to trade the currency pair EUR/USD. You set the volume of opening position as 1 lot and leverage as 1: 100. Your opening price is 1.1200, while your closing price is 1.1250. You fill in the information above in the Exness Calculator. Here are the results you will get:

- Profit: The estimated profit for this trade will be calculated based on the pip movement (50 pips).

- Margin: The margin required for this trade will be displayed, helping you determine if you have sufficient funds.

Calculating Margin Example

Then, to know the margin for the same trade in the EUR/USD, let’s assume you will apply leverage of 1:100. If the size of the lot is 1 lot and its equivalent value is 100 000 units with an applied leverage of 1:100, the margin can be determined by the quotient of the division of the total trade value by the value of the leverage. Placing these values in the calculator, it will give you the margin requirement, which is a fraction of the whole trade value, whereby you will actually know how much capital you need to open up the trade.

Advanced Features of the Exness Calculator

Advanced features will help traders in the Exness Calculator to plan the trade with more precision, including the following specific features of risk management, customization of calculations, and integration with trading platforms, will serve users in making better decisions.

Advanced Risk Management

The calculator further assists traders in advanced risk management by providing precise calculations of margin, pip value, and swap fees. This, in turn, will help them correctly estimate the amount of money they are exposing in the market and enable them to make appropriate changes. By calculating the potential profit and loss, a trader is then able to set appropriate Stop-Loss and Take-Profit levels to manage their effective risk.

Customization Options

The Exness Calculator is permitted with various settings. The input parameters can be changed according to a certain account type, leverage, and trading instrument preferred by the trader. This will articulate, to a high degree, the results concerning an individual strategy with precise data, somehow mirroring the style of the trader and his risk tolerance.

Integration with Trading Platforms

The Exness Calculator works perfectly with MT4 and MT5, as it provides ease in applying the calculated metrics to either trading platform. This in turn will help in smoothing out the process of planning a trade on the calculator and then running it seamlessly on their chosen platform, ensuring both accuracy and efficiency.

Conclusion

An Exness calculator is important, therefore, in the development and proper risk management strategy that any trader may want to operate within, considering potential profit or loss. This calculator will be useful in determining such things as margin or swap fees, among other features, through its user-friendly interface and rich functionality; it will enable traders to make well-calculated decisions by providing valuable data based on their input parameters. Whether a person is a rookie or an advanced trader, he will find that an Exness Calculator will make trade planning less susceptible to mistakes. This kind of calculator is a must when one is enacting success within the markets and upgrading one’s approach to trading in general.

FAQ

What is the Exness Calculator?

The Exness Calculator is a tool that helps traders estimate key metrics like margin, swap fees, and profit/loss before placing trades.