- Exness Funding Options

- Exness Deposit Methods

- Minimum Deposit Requirements

- How to Deposit Funds into Exness Account

- Processing Times and Fees for Deposits

- Exness Withdrawal Methods

- Minimum Withdrawal Requirements

- How to Withdraw Funds from Exness Account

- Processing Times and Fees for Withdrawals

- Local Exness Payment Options for Nigerian Traders

- Security Measures and Verification

- Troubleshooting Common Issues

- Choosing the Best Exness Payment Method

- Conclusion

- FAQs

Comprehensive Exness Funding Options

Exness works with trusted payment companies. This helps make sure your deposits and withdrawals are safe. The company understands how important it is to have an easy way to manage your trading funds.

| Payment Method | Minimum Deposit | Maximum Deposit | Deposit Fee |

|---|---|---|---|

| Credit/Debit Card | $10 | $40,000 | Free |

| Bank Wire Transfer | $100 | No limit | $10-$35 |

| Skrill | $5 | $40,000 | Free |

| Neteller | $20 | $30,000 | 2.5% |

| UnionPay | $100 | $100,000 | Free |

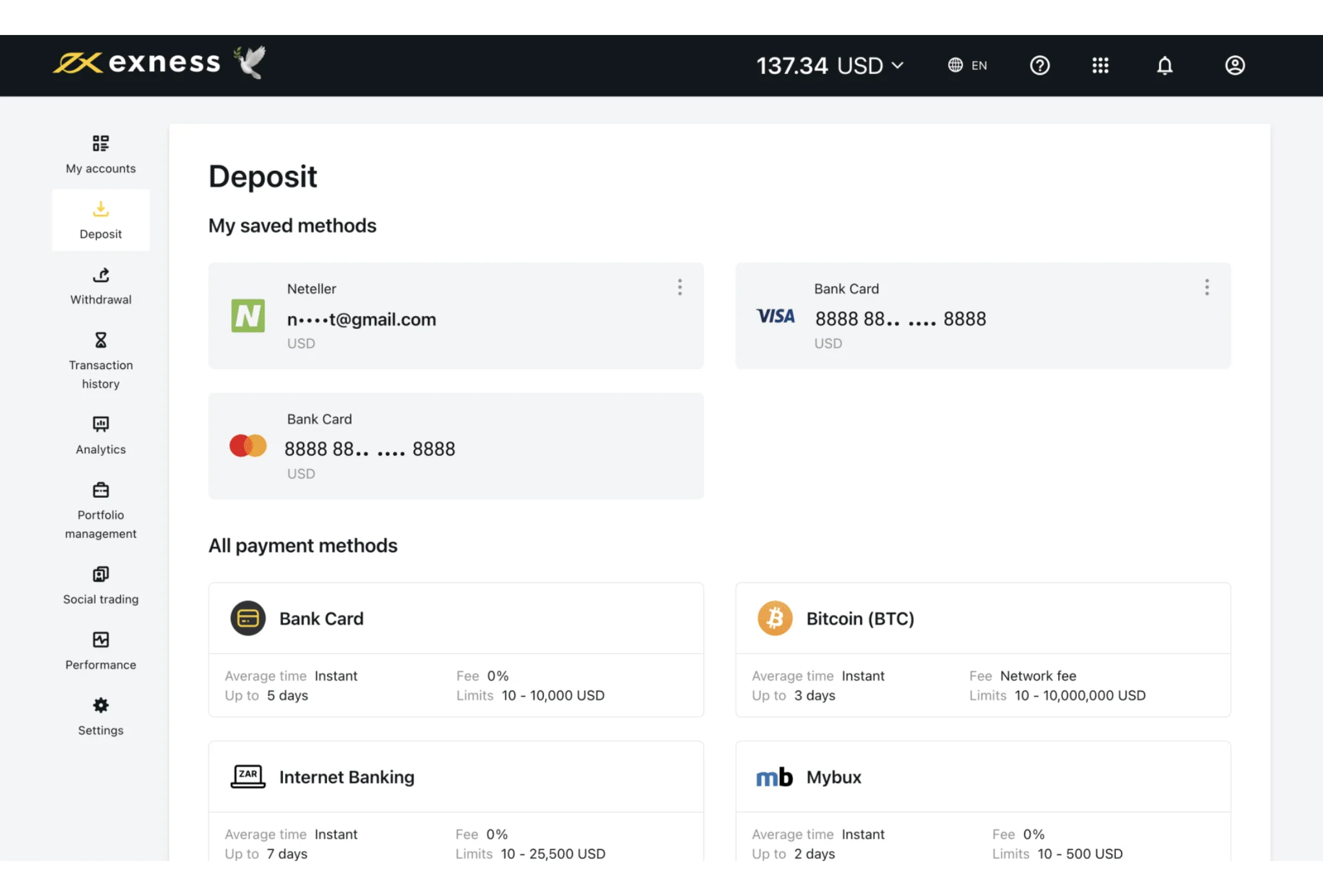

Exness Deposit Methods

Exness allows you to deposit money in multiple ways. So that you can select the right choice for you.

Supported Deposit Methods

At Exness, the following methods can be used to fund trading account:

- Credit/debit cards (Visa, Mastercard, Maestro)

- Bank wire transfers

- E-wallets: Skrill, Neteller, UnionPay

Some traders use wallets because their money is quickly deposited into the account. A lot of people enjoy bank wires [when they make] big deposits. Also one easy way you can do is only with credit or debit card.

Local deposit methods differ from one county to the next.

Minimum Deposit Requirements

Exness appreciates that not everyone can start with a lot of money. This is why they accept a small minimum deposit. And with e-wallets such as Skrill or WebMoney, this amount can go as low as $5 when making your first trade.

The exception of bank wires with a minimum of $100. The reason for this higher amount is to cover the fees charged by banks for wire transfers.

A credit/debit card allows for the most manageable minimum deposit of $10 which is actually an amount that can be afforded by most traders.

Regardless of the deposit method the objective of Exness is to keep you on your trading, not payments.

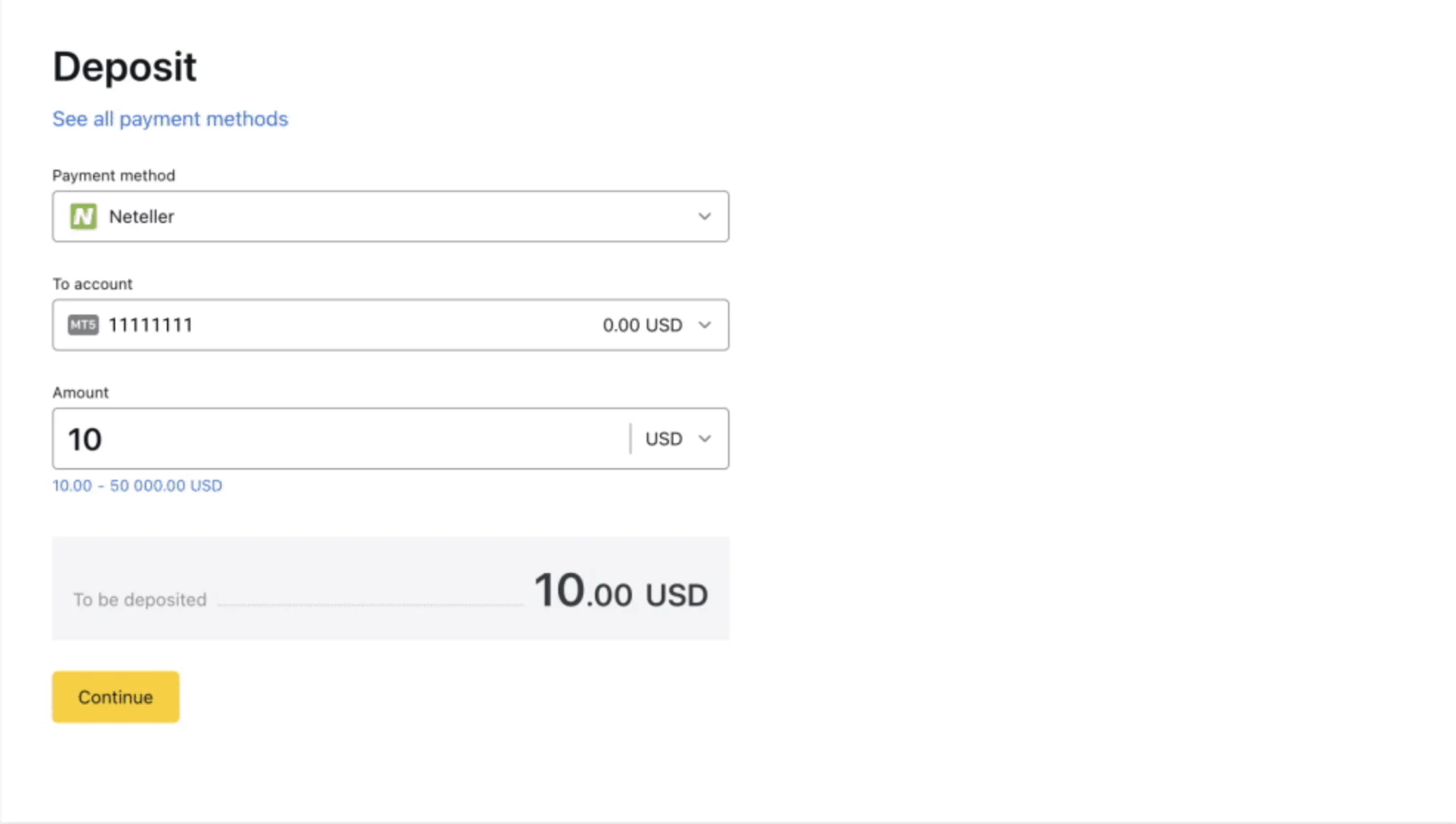

How to Deposit Funds into Your Exness Account

You can fund your Exness trading account by following these steps:

- Log in to your Exness account

- Go to the “Deposit” section

- Pick how you want to deposit:

- Credit/debit card

- E-wallet (like Skrill or Neteller)

- Bank wire transfer

- If using a card, enter your card details and deposit amount

- For e-wallets, you’ll go to their website to complete the deposit

- For bank wires, provide your account number and bank details

Just a few clicks and your money will be in your trading account soon.

Processing Times and Fees for Deposits

How long it takes for your deposit to show up depends on the payment method:

- E-wallets and cards are usually instant or very fast

- Bank wires can take several days

As for fees:

- Most deposit methods at Exness are free

- But bank wires may have a fee of $10-$35

- Some e-wallets like Neteller charge a small percentage fee

Always check the specific fees and times for your deposit method. That way you know when your funds will be ready for trading.

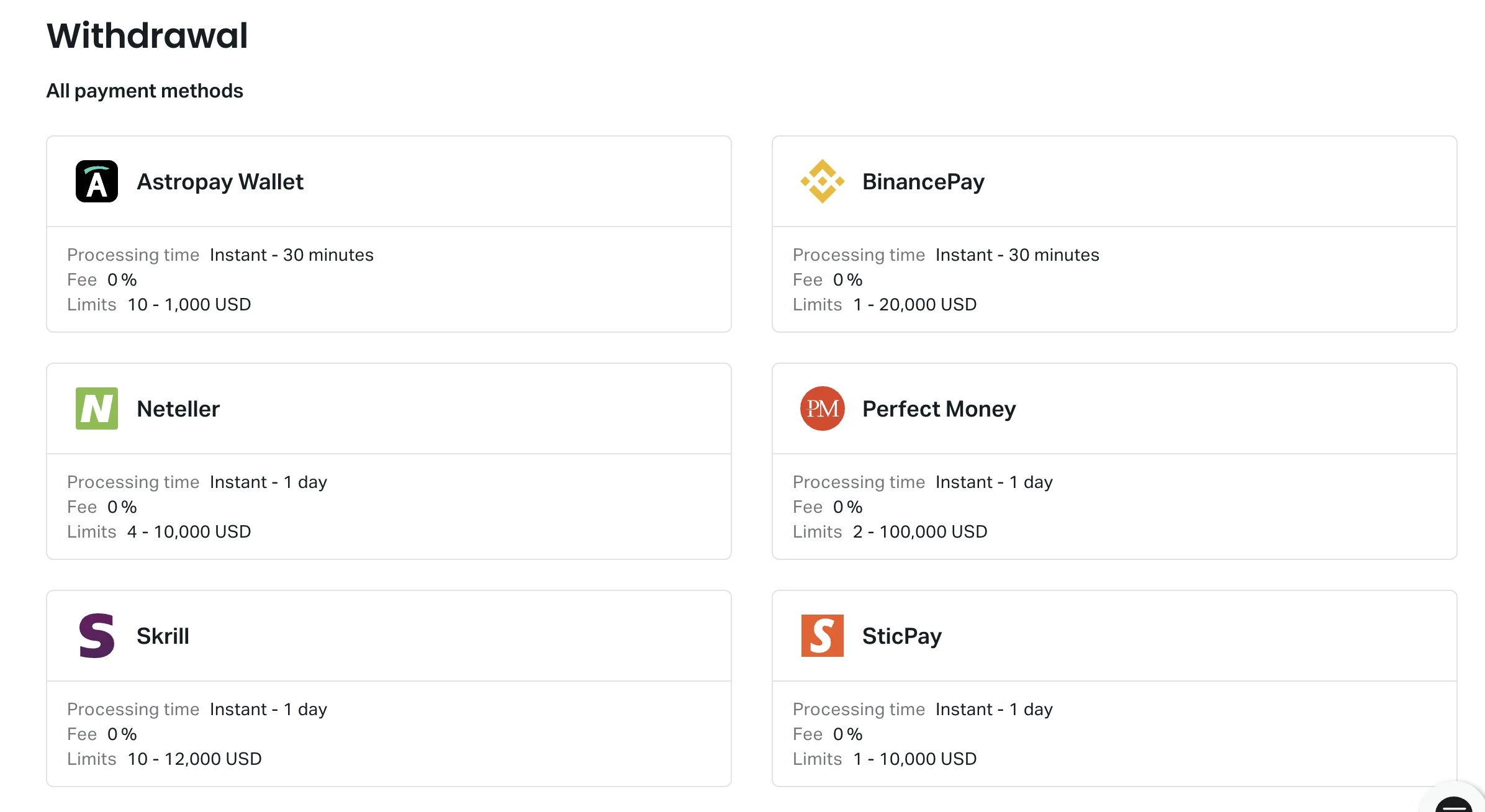

Exness Withdrawal Methods

Exness offers a variety of ways to withdraw your trading profits when it comes time for cash out.

Supported Withdrawal Methods

Withdraw funds from Exness account using:

- Credit/debit cards

- Bank wire transfers

- Skrill, Neteller, WebMoney, and UnionPay – E-wallets that everybody knows.

The fastest withdrawals e-Wallets limit of up to 24 hours Bank wires (suitable for larger amounts) If you are using a card, they can be an easy solution as long as you deposited with one initially.

Minimum Withdrawal Requirements

Minimum withdrawal amount changes respectively in every method

- E-wallets like Skrill: $5 minimum

- Bank wire: $30 minimum

- Credit/debit cards: $10 minimum

These minimums are intended to cover any transaction fees that arise. Larger sums have fewer fees as a percentage of the total.

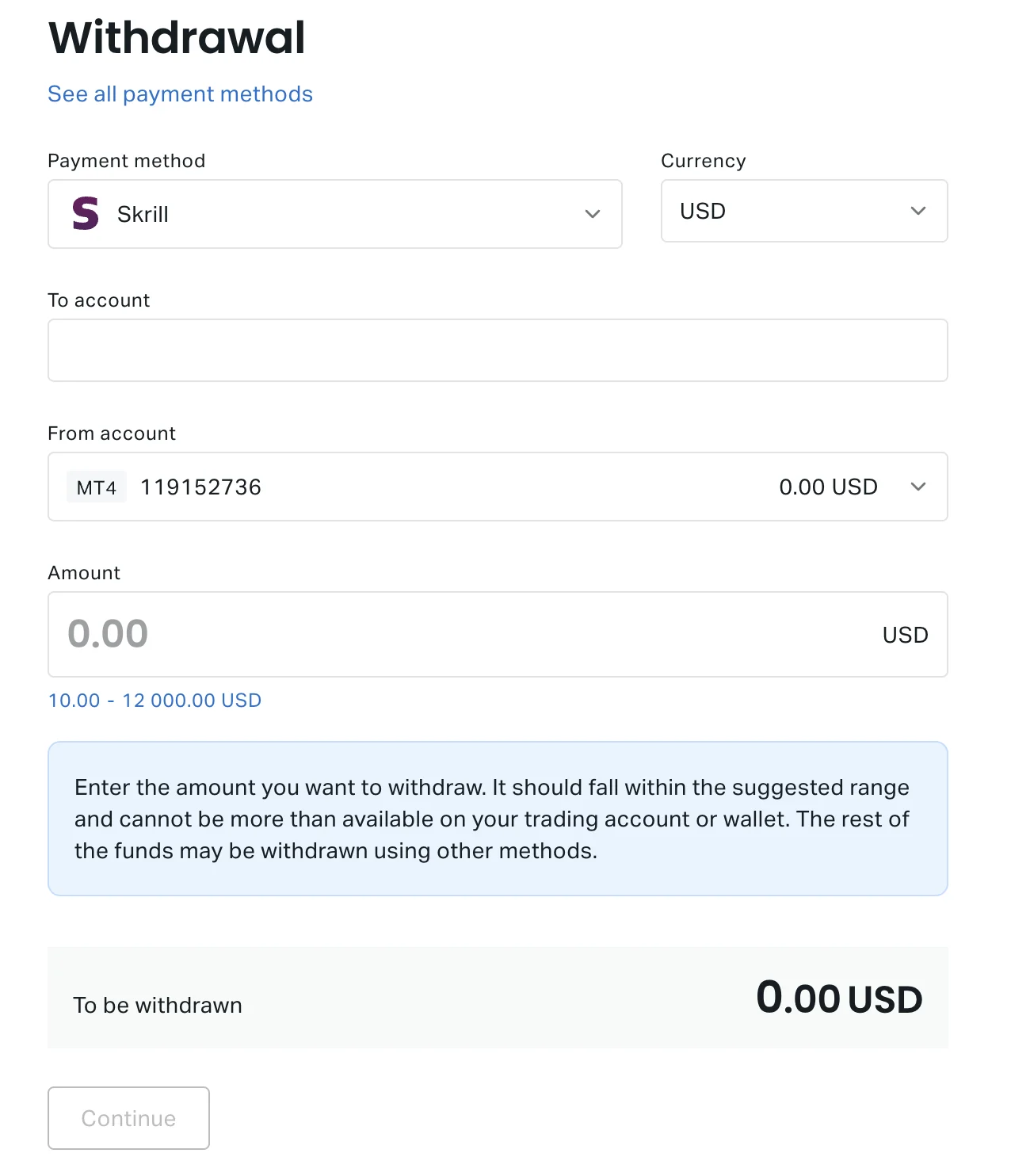

How to Withdraw Funds from Your Exness Account

To withdraw funds:

- Log into your Exness account

- Go to the “Withdrawal” section

- Choose the withdraw method of your preference

- Enter the required details (card number, bank details, etc.)

- Enter the amount you wish to Withdraw

- Verify the withdrawal request by clicking Review and confirm

When requested, the withdrawal is processed according to Exness’ security controls.

Processing Times and Fees for Withdrawals

The soonest you can get your hands on will probably be withdrawing via E-wallets, they usually take 1-2 business days for processing. A card withdrawal takes 3-5 business days Bank wires can take the longest at 5-7 business days.

As for fees, Exness does not charge them at all. Banks, however deduct a wire fee that is generally between $10-$35. Note also that there are a 2% E-wallet withdrawal fee (on Neteller, for example)

Before you decide how you want to withdraw your funds, do consider processing times and fees. For more about choosing the right Exness options, Visit here.

Local Payment Options for Nigerian Traders

For traders in Nigeria, Exness has some local payment choices made just for you. You can add money using the Opay mobile money service. Or, you can deposit straight from your Guaranty Trust Bank or Zenith Bank account.

Using these local options can be easier and cheaper than international methods. But the limits on how much you can transfer or how fast it goes through may be different.

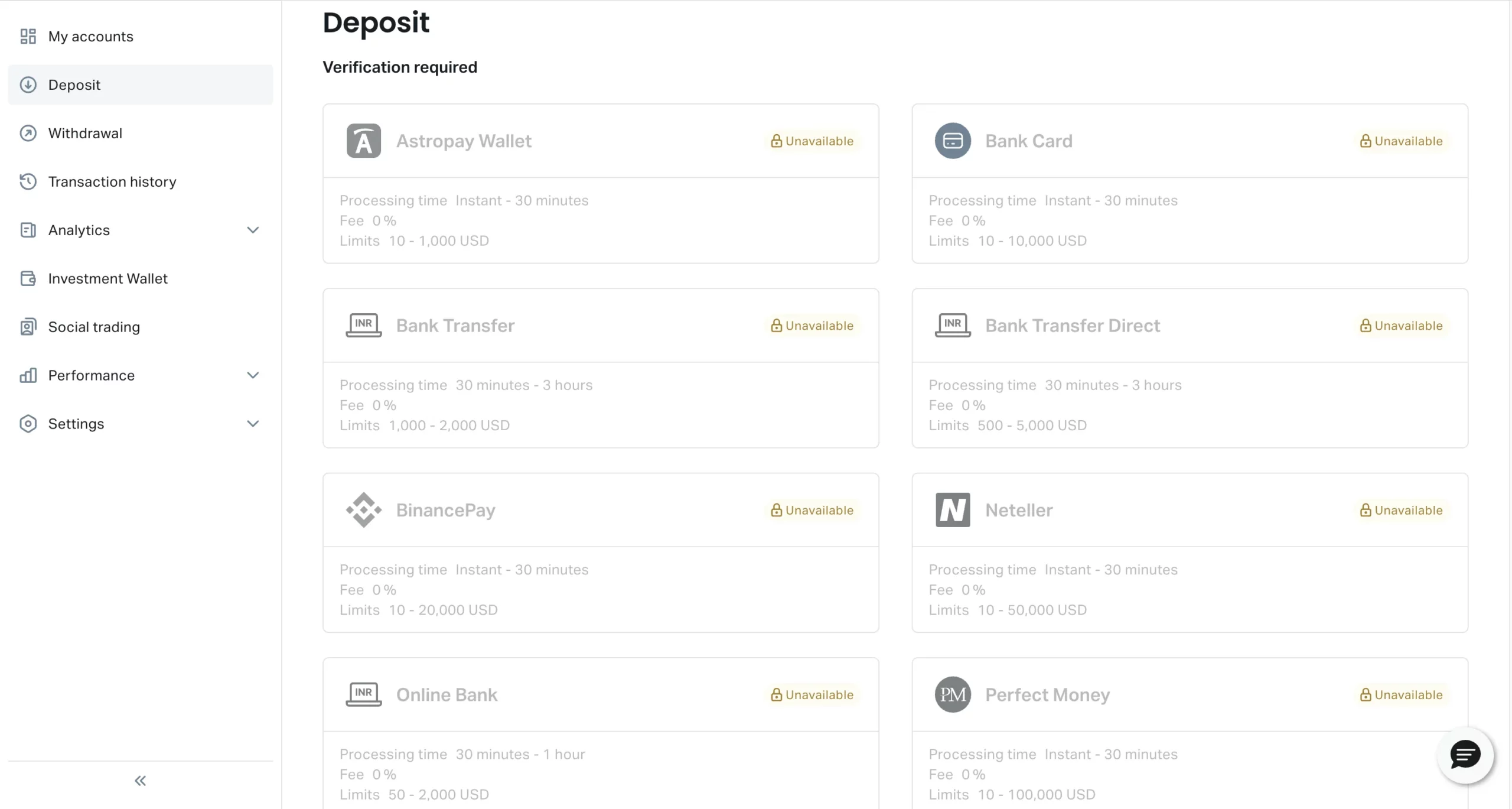

Security Measures and Verification

Keeping money and information safe is very important. Exness does a few things to protect traders:

- Encrypts all communications to keep data secure

- Keeps client funds separate from company money

- Checks everyone’s identity before opening new accounts

Traders may need to provide some documents like a government ID, proof of where you live, and details on where your money comes from. This helps prevent fraud and illegal activities.

Troubleshooting Common Issues

Sometimes deposits or withdrawals can hit a snag. If that happens, the Exness support team is there to help. Common problems may include:

- Transactions getting declined due to not enough funds or card limits

- Entering the wrong payment details

- Technical errors during the payment process

Support can walk through fixing the issue or look into it further if needed. Don’t hesitate to contact them – their job is to solve any problems quickly.

Choosing the Best Exness Payment Method for Your Needs

With all the different options, picking the right payment method can be tricky. Think about things like:

- How easy and convenient it is to use

- Any fees involved

- How fast transactions process

- Limits on how much you can transfer

- If local options are better for you

For example, e-wallets are great for fast, low-cost deposits but may charge fees for withdrawals. Bank wires work well for larger amounts despite being slower. It depends on how you like to trade and your personal preferences.

Conclusion

Exness gives plenty of ways to deposit and withdraw funds easily. This includes specific local Nigerian options too.

They take safety very seriously, verifying accounts and protecting your data. And if any issues pop up, you can count on their support to resolve things smoothly.

By considering all the different payment methods, traders can choose the ones that fit their trading style and needs best. That way, you can focus on your strategies rather than worrying about moving money around.

FAQs

Got questions about funding your Exness account? We’ve got answers! Here are some common queries traders have:

What deposit methods are available for Nigerian traders on Exness?

If you live in Nigeria, Exness has some local deposit options. You can add money using the Opay mobile money service. Or, you can deposit straight from your Guaranty Trust Bank or Zenith Bank account.